pay estimated indiana state taxes

Pay State Estimated Quarterly Taxes Online On Time Official Payments makes it easy to pay state estimated quarterly taxes using. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

How To Pay Estimated Taxes.

. 10 for up to 9950 for single filers. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Use a pre-printed proof of estimated taxes issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated taxes.

Access INTIME at intimedoringov. Many taxpayers have enough taxes withheld from their income throughout the year to cover their year-end. Estimated payments may also be made online through Indianas INTIME website.

The state tax Indiana collected 164 billion in income taxes during fiscal year 2018 which was a 54 increase over fiscal year 2017. Line I This is your estimated tax installment payment. Lines J K and L If you are paying only the.

That means no matter how much you make youre taxed at the same rate. The Indiana income tax system is a pay-as-you-go system. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not. Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. March 16 2020 230.

The Indiana personal exemption includes a 1500. If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. The average income tax rate for counties and large municipalities is 116 according to the Tax Foundation weighted by income.

All counties in Indiana impose their own local. To make an individual estimated tax payment electronically without logging in to INTIME. DOR Tax Forms Online access to download and print DOR.

The tax bill is a penalty for not making proper estimated tax payments. When paying your Indiana income taxes things can. Cookies are required to use this site.

If the amount on line I also includes estimated county tax enter the portion on. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Your average tax rate is 1198 and your marginal tax rate is.

Your browser appears to have cookies disabled. 22 on money earned between 40526 to 86375 single filers 32 on money earned between 164926 and 209425 again single. And your payment is processed immediately.

We last updated the. Indiana Form IT-40 calls for Schedule 5 as the source for entering Estimated tax paid and you will notice that form is not currently available in Turbo Tax. Residents of Indiana are taxed at a flat state income rate of 323.

Indiana Income Tax Calculator 2021. Select the Make a Payment link under the.

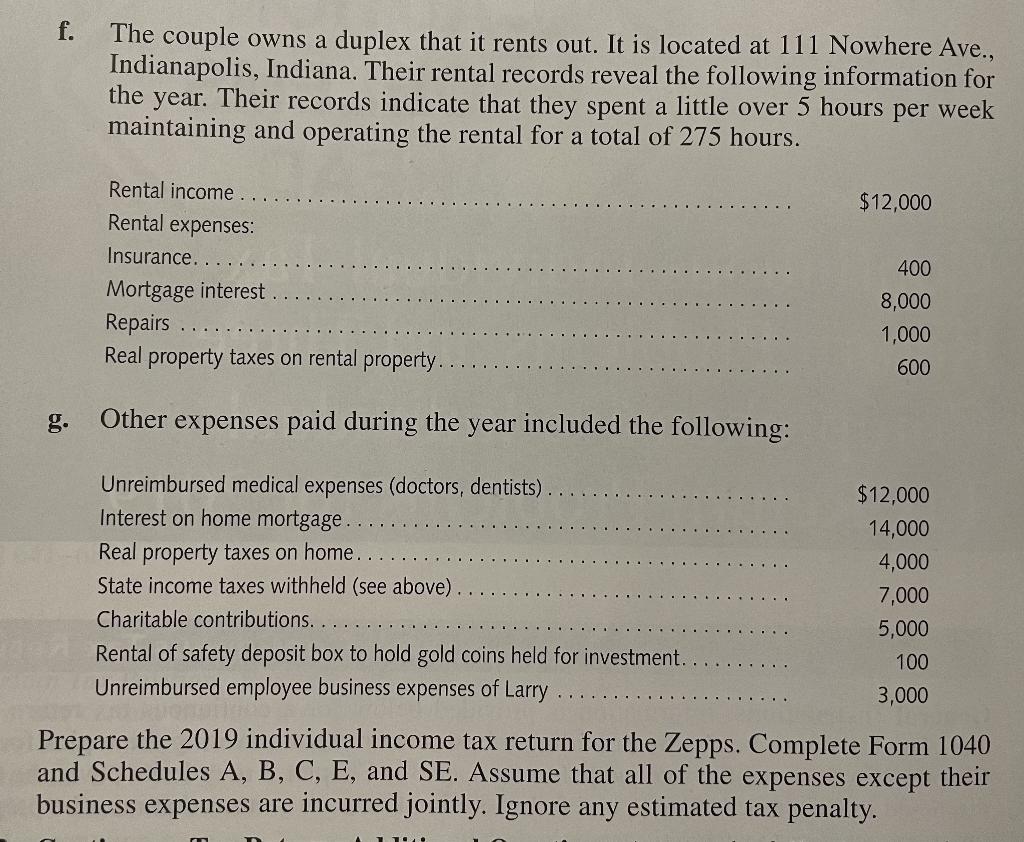

Solved Chapter 3 Continuous Tax Return Problems 3 1 Problem Chegg Com

As Indiana Considers Second Tax Refund Some Wonder Where S The First Inside Indiana Business

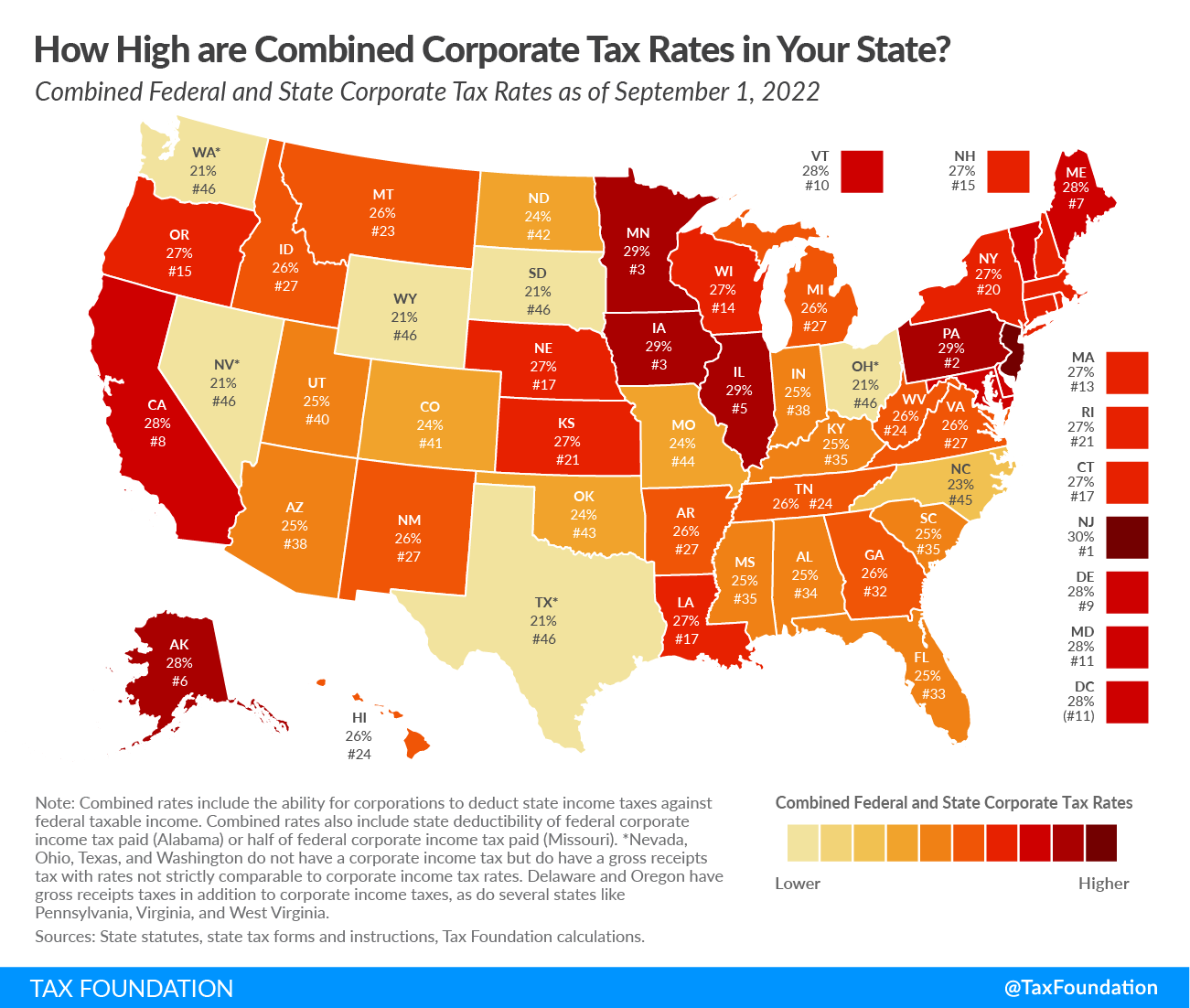

Indiana Tax Rates Rankings Indiana State Taxes Tax Foundation

Indiana Income Tax Calculator Smartasset

Hoosiers Businesses Able To Easily File Pay Taxes On State Web Portal Indiana Public Radio

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Tax Breaks 325 Checks Headed To Indiana Residents Indiana News

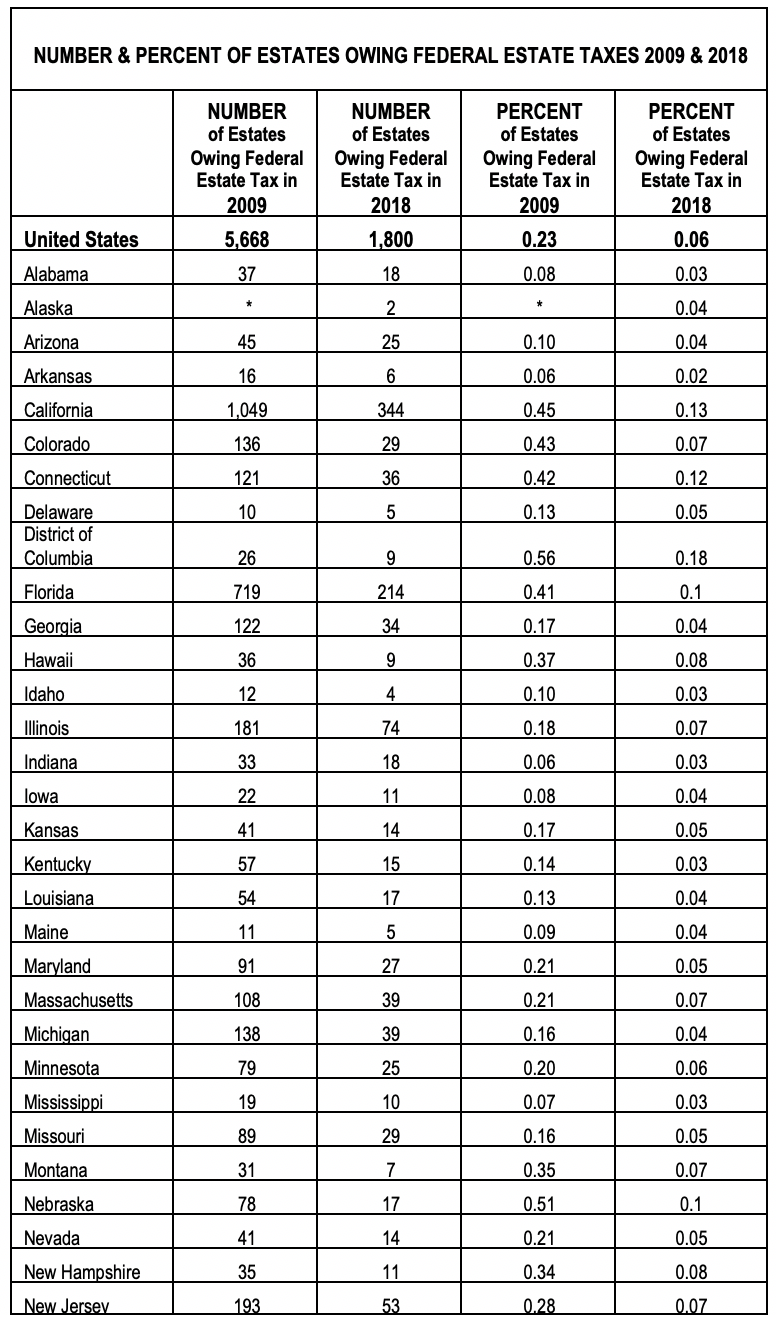

Gomez Estate Tax Bill Will Affect Very Few Estates State By State Estimates Americans For Tax Fairness

Dor Completing An Indiana Tax Return

Indiana Tax Rates Rankings Indiana State Taxes Tax Foundation

Fill Free Fillable Forms State Of Indiana

Indiana State Tax Refund In State Tax Brackets Taxact

Guide And Calculator 2022 Indiana Sales Tax Taxjar

Indiana Income Tax Rate And Brackets 2019

Estimated Income Tax Payments For Tax Year 2023 Pay Online