does idaho have inheritance tax

Idaho does not levy an inheritance tax or an estate tax. States That Have Repealed Their Estate Taxes.

Nude Gingrich On Twitter Hi Everyone Mike Crapo Here I Want Rich People To Be Even Richer And I Don T Care About Anything Else Thanks Again My Name Is Literally Mike Crapo

Based on changes to the tax.

. Idaho does not have an estate or inheritance tax. Estates and Taxes. No estate tax or inheritance tax.

The top estate tax rate is 16 percent exemption. A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will. No estate tax or inheritance tax.

In other words the estate itself can be taxed for the amount that is above the exemption cut-off. Idaho Inheritance and Gift Tax. Differences Between Inheritance and Estate Taxes.

When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice. Idaho does not have an estate or inheritance tax. The top estate tax rate is 16 percent exemption threshold.

Even though Idaho does not collect an inheritance tax however you could end up paying. On the other hand you. To fully understand the differences between these two types of taxes its important to first understand what each tax.

Seven states have repealed their estate taxes since 2010. Idaho Inheritance Tax Laws. Keep in mind that if you inherit property from another state that state may have an estate tax that applies.

Idaho does not levy an inheritance tax or an estate tax. The top estate tax rate is 16 percent exemption threshold. For more details on Idaho estate tax requirements for deaths before Jan.

Its essential to remember that if you inherit. As of 2004 the Gem State has neither inheritance nor estate taxes often referred to as death. Also gifts of 15000 and below do not.

Also gifts of 15000 and below do not require any tax. There are 38 states in the country. A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will.

If you live in Oregon you can be happy that you dont have to pay both an estate tax and inheritance tax like people in Maryland. Delaware repealed its tax as of January 1 2018. The US does not impose an inheritance tax but it does impose a gift tax.

Idaho might be the most tax-friendly state for those who inherit an estate there. Idaho does not have an estate or inheritance tax. If the total value of the estate falls below the exemption line then there is no.

Our Idaho retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. As of 2004 the Gem State has neither inheritance nor estate taxes often referred to as death taxes However Idaho. Idaho has no state inheritance.

The Oregon Estate Tax. The gift tax exemption mirrors the estate tax exemption. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004.

No estate tax or inheritance tax. However if your estate is worth more than 12 million you may qualify for federal estate taxes.

Estate And Inheritance Taxes By State In 2021 The Motley Fool

People Fleeing California For Record Tax Relief Investments In Idaho Fox Business

Wills And Trusts Archives Evergreen Elder Law

Estate Planning Attorney Boise Id Estate Planning Checklist Truenorth Wealth

Boise Idaho Personal Estate Planning Services Generations Law Group

Idaho Inheritance Laws What You Should Know

Idaho Estate Tax Planning The Ultimate Guide

Idaho State Tax Guide Kiplinger

State Tax Information For Military Members And Retirees Military Com

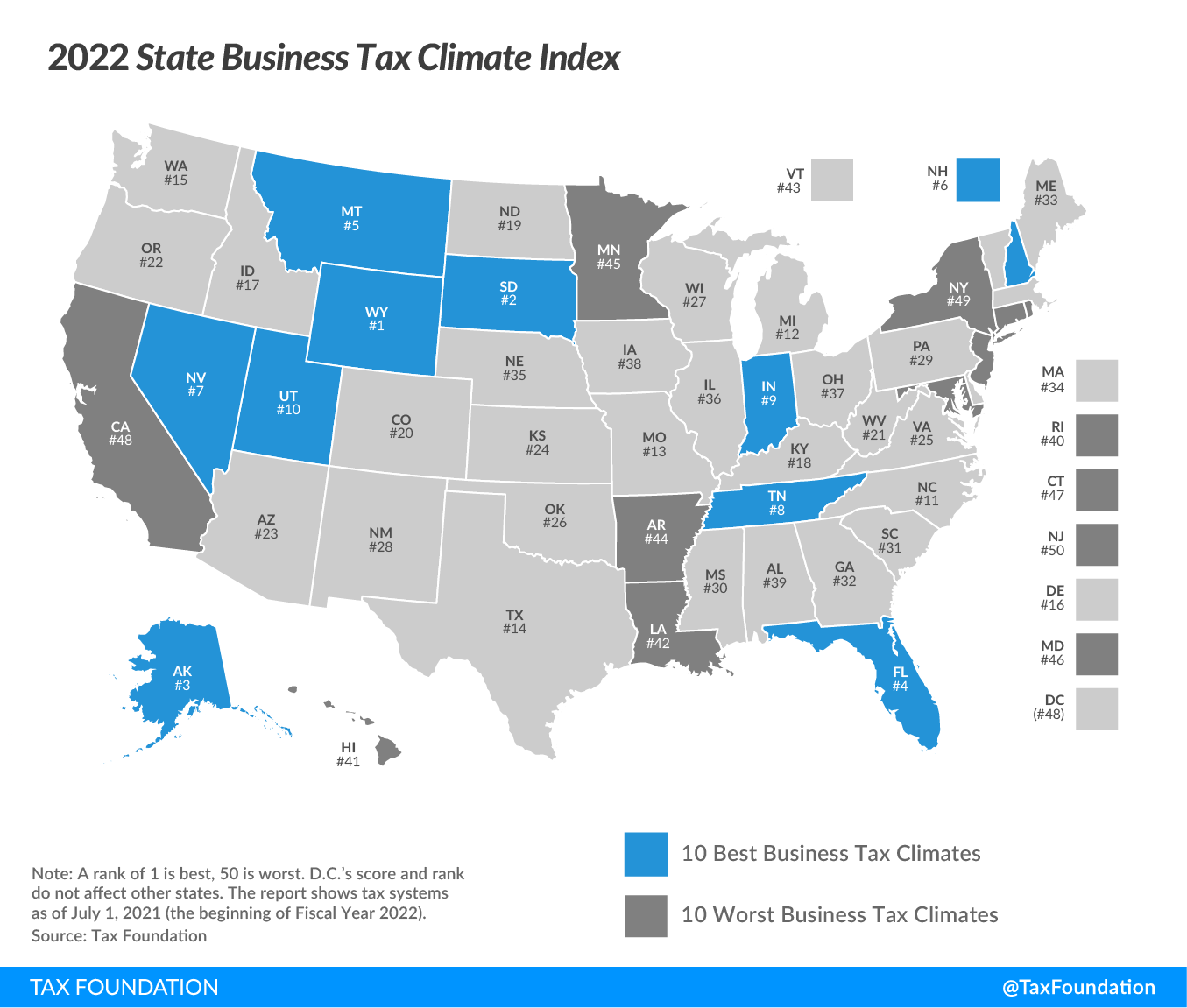

2022 State Business Tax Climate Index Tax Foundation

Letters To The Editor Idaho S Senators Abortion Sawtooths Idaho Statesman

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Using Gifting Between Spouses To Maximize Step Up In Basis

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Idaho Estate Planning New Parent Tax Planning Could Include Ira For The Baby